Stock / Symbol: Coca Cola / KO

Stock / Symbol: Coca Cola / KO

Price at trade post: $67.85

Option Strategy: [private_monthly]call ratio calendar spread[/private_monthly]

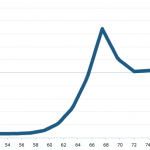

Reasoning:[private_monthly] Since last April, KO has traded in a tight range, between a 63 and 71. We're putting on a version of a calendar spread designed to reach maximum value with KO at $67.50 by February expiration, and offer us some protection should the stock break out to the upside. The maximum yield on the trade is 63% by Feb 17 but we'll look to close out the trade earlier with around a 20% profit. [/private_monthly]

Trade Details : [private_monthly]

BTO 8 KO May12 67.5 Calls

STO -7 KO Feb12 67.50 Calls

for a net debit of $9.48 per contract (GTC, limit order)

[/private_monthly]

Requirements

Cost/Proceeds: $948

Option Requirement: $0

Total Requirements: $948

Estimated Commission: $18.75

Max Risk: $948

Profit Range: $65.65 – 70.40 (Feb 17)

Max Profit: $600 or 63% @ $67.50 by Feb 17

Suggested Downside Stop: @ $63.30

Suggested Upside Stop: @ $70.50

Speak Your Mind