Stock / Symbol: [private_monthly]ProShares UltraShort 20+ Year Treasury / TBT [/private_monthly] Option Strategy: [private_monthly]call ratio spread, switching to vertical call spread[/private_monthly] Trade entry date: Oct 13 Price at entry: $20.86 Price at this post: $18.98 [Read More …]

Order Correction : KO

Trade Details : [private_monthly] BTO 8 KO May12 67.5 Calls STO -7 KO Feb12 67.50 Calls for a net debit of $9.48 per contract (GTC, limit order) [/private_monthly] Requirements Cost/Proceeds: $948 Option Requirement: $0 Total [Read More …]

New Trade : KO

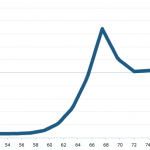

Stock / Symbol: Coca Cola / KO Price at trade post: $67.85 Option Strategy: [private_monthly]call ratio calendar spread[/private_monthly] Reasoning:[private_monthly] Since last April, KO has traded in a tight range, between a 63 and 71. We’re [Read More …]

Trade Adjustment / New Trade Opp : call ratio spread

Stock / Symbol: [private_monthly]ProShares UltraShort 20+ Year Treasury / TBT [/private_monthly] Option Strategy: call ratio spread Trade entry date: Oct 13 Price at entry: $20.86 Price at this post: $19.66 Current Position:[private_monthly] Long 3 TBT [Read More …]

Closing Trade : X call ratio spread

Stock / Symbol: US Steel / X Option Strategy: call ratio spread Trade entry date: Oct 25 Price at entry: $22.73 Price at this post: $26.40 Reasoning: With our short calls well ITM, we’re going [Read More …]

New Trade : call ratio spread

Stock / Symbol: [private_monthly]US Steel / X[/private_monthly] Price at this post: $22.65 Reasoning: [private_monthly]X[/private_monthly] reported this morning and beat the street’s revenue projections. However, guidance was bad and the stock is down 8.6% ($22.64). We [Read More …]

New Trade : call ratio spread

Stock / Symbol: [private_monthly]ProShares UltraShort 20+ Year Treasury / TBT [/private_monthly] Option Strategy: call ratio spread Price at this post: $20.90 Reasoning: Looks like [private_monthly]TBT[/private_monthly] is finally bottoming, so we’re going to re-enter a trade [Read More …]